Advancements in technology have led to an alteration in many domains of our life. More or less, they are aimed at reducing the hassle of getting our needs met. When there has been a shift in all domains of our life, E-wallet app development has led to a change in the usage of money. Instead of handling hard cash, mobile wallet app development has led to the handling of money in a much more handy and secure way. Money plays an essential role in getting even our basic needs quenched, and it is almost confusing to count notes and find exact change to pay for every service and goods we avail. Mobile wallet apps help avoid this trouble. And ever since the global pandemic, most transactions are taking place through digital modes to prevent virus contractions through the handling of cash. Hence, most of the business has turned towards integrating the digital wallet system into their business.

How does it work?

- Users login and create a profile like every other app. They are asked to link their bank accounts in the e-wallet app profile. It is safe and accessible only by the user.

- After linking the bank accounts, users can easily carry out their payment process with just a few steps. They can transfer money to other users by syncing their contact list in the app. The added benefit is they can move the exact amount they want. This avoids the problem of searching for change while carrying out the traditional way of payment.

- They can pay bills, buy essential goods, spend on shopping, recharge their mobile phones, and much more. Almost all payment processes are done at their comfort.

- Users can also pay the vendors directly at shopping sites with the help of the e-wallet apps. The shop must also link itself to the e-wallet app.

- Users are notified about all their transaction processes. They also receive regular updates on promo offers, cashbacks, loyalty points, and much more.

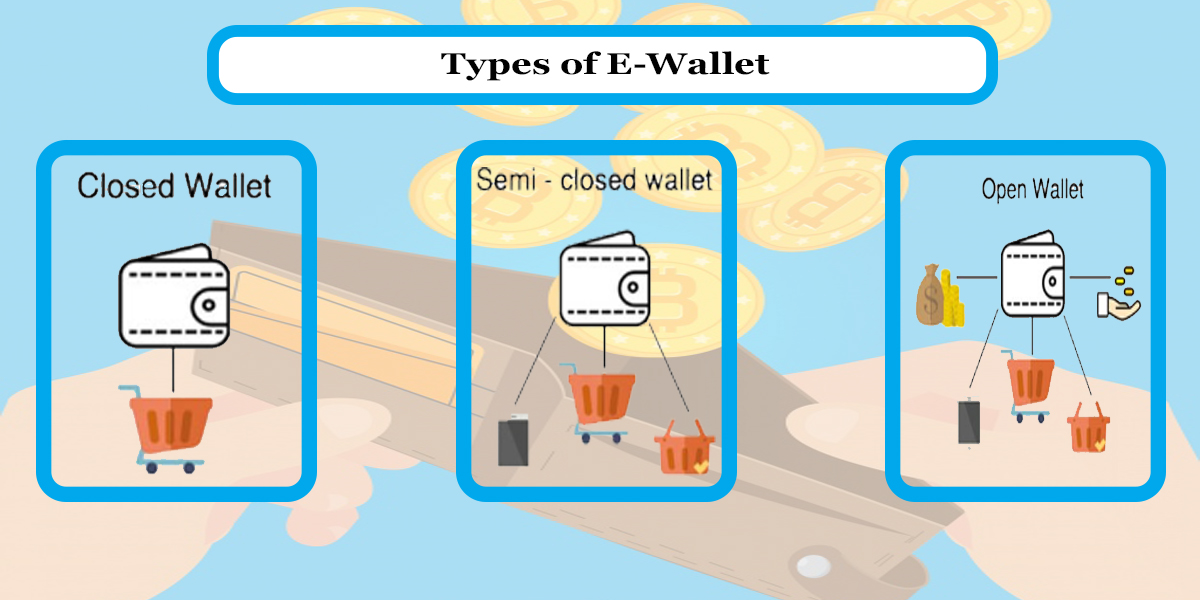

Types of e-wallet apps

Before carrying out e-wallet app development, you need to narrow down on the type of app you want to develop.

-

Open wallet apps

These wallets help in carrying out payments between the users and also aids to withdraw cash from the ATMs and banks. Banks mostly issue them. They carry out all the transactions of a semi-closed wallet as well.

-

Closed wallet apps

These are e-wallet apps integrated into a pre-existing app. This helps the users to avail of their frequent services with ease. They are generally integrated into shopping apps, taxi booking apps, movie booking apps, food delivery apps, and much more.

-

Semi-closed wallet apps

These apps help in carrying out payment in both online and offline modes. They help in carrying out all payment processes like buying goods, bill payments, and much more. These apps generally require approval from the national bank.

Features of an e-wallet app

- Admin panel

Dashboard

The admin of the app can manage the app’s process and monitor it quickly in a common platform.

User management

The admin has a database of all users and the other business merchants who have linked themselves to the app. The data is highly secure and encrypted.

Promo offers

The admin can notify the users of promo offers, loyalty rewards, discounts as such.

Revenue management

The admin can effectively manage the revenue generation based on insights provided in the app.

Real-time analytics

The admin receives real-time analytics and reports of the user behavior. This helps to upgrade the app as per the needs.

- User app

Registration and Account Integration

Users can sign up and create a profile for themselves using the verified details. Later they are prompted to link their bank accounts with the app.

Add and check the balance

Users can check their balance quickly, and they can add money in their accounts to carry out transactions.

Money Transfer

Users can transfer money at any time and from any part of the world. This flexibility in the transaction makes e-wallet apps the best.

Pay Bills

Users can pay their bills, buy goods, and avail services efficiently at their comfort.

Transaction History

All the transaction details are stored in the app for future reference. This helps the user keep track of the transactions and their expenses.

- Merchant app

Effective panel and dashboard

The merchant is given an active panel to aid in carrying out the business process and payment transactions smoothly and securely.

Adding products

The products can be listed with their prices, and this can be integrated into the e-wallet app.

Customer management

Merchants can manage their customers and can also notify them on promo offers and discounts through the app.

QR code

Merchants can create a QR code that is exclusive for their business. This helps the users carry out the transactions easily by scanning the code for payments.

EMI payment

Users can be allowed to pay through EMI plans by integrating the feature into the app.

Employee management

Admin can also manage their employees and notify them about any updates through push notifications.

Technology stack

Few updated tools and technologies that can be deployed in mobile wallet app development are,

- Mobile technologies

Objective C, Swift, Java, Kotllin, Android SDK, Xcode.

- UI/UX

Photoshop, Sketch, After effects, InVision, Illustrator, Flinto.

- Web

HTML, Backbone JS, Angular JS, Vue.Js, React JS, Node.JS.

- Backend

Node.Js, Python, PHP, Django, MongoDB, Redis.

- App analytics and payment

Apple Pay, Google Wallet, Braintree, Flurry, Stripe, Google analytics.

- Cloud service

AWS, Firebase, GoogleAE, Pushwoosh.

Solutions that a digital wallet app development company should provide in the app

- Friendly User interface

Users must be able to access the app easily. It should be simple and understandable even to a layman. The minimalist experience of the UI will enable the users to visit the app continuously for their transactions.

- High efficiency and transparency

The app should work with reasonable ability, and all the transactions taking place in the app should be done in a jiffy. The money deducted and credited will be notified continuously to the users, thus providing a transparent user experience.

- Secure payment

The linked bank accounts and all the transactions of the users should be encrypted and secured. Users must be guaranteed of their wallet safety.

- Scalability

There should be room for updating the app according to the change in the market trends.

- Technical support

The app development firm should provide extensive technical support throughout the app development, launch, and usage.

Even when the barter system existed, there was always a need for an effective medium to exchange goods and services. Along the line, after money was invented, it was used as a proficient medium. And then, after several decades, digital money has revolutionized the way payments are handled. All of us look forward to earning sufficient cash in the future, but as Bill Gates says, “The future of money is a digital currency.”

We might not be sure how things could craft themselves in the future, but digital currency is expected to rule the world for several decades.

Get your affluent mobile wallet app

Marketing is my soul mate and writing is my side kick. Using my writing skills to share the knowledge of app development and upcoming technologies.

7 Comments